ISO 20022 Coins Explained – List of ISO 20022 Compliant Coins [2025]

Blockchain

August 21, 2025

Copy link

Dimpal Kumar

Co-Founder

Table of contents

Table of contents

Banks worldwide are switching to a new “language of money.” By 2025, nearly 90% of global high-value payments including financial giants like SWIFT, the Federal Reserve, and European payment systems will fully adopt ISO 20022 — a global messaging standard for payments.

Now here’s the twist: out of 10,000+ cryptocurrencies, only a handful are ISO 20022 compliant coins. These coins are positioned not as hype tokens, but as infrastructure assets that can actually work with banks, payment systems, and CBDCs.

For investors, developers, and businesses, this means a potential once-in-a-decade opportunity. ISO 20022 coins aren’t just another crypto list — they may become the bridge between blockchain and global finance.

Let’s explore the ISO 20022 crypto coins list (2025) and why compliance could decide which cryptos survive the next wave of regulation.

ISO 20022 is a global standard for electronic data exchange between financial institutions. It allows richer, structured, and interoperable data exchange for payments, securities, trade, and FX transactions.

Think of it as a “universal dictionary” that ensures banks, payment processors, and even blockchain projects can communicate seamlessly.

For crypto, being ISO 20022 compliant means the token can seamlessly integrate into this global financial “language.” ISO 20022 coins are cryptocurrencies built to comply with ISO 20022, the global standard for financial messaging.

Why does this matter? Because by 2025, banks and payment networks that move over $200 trillion every year will be required to adopt ISO 20022. Coins aligned with this standard are better positioned for integration into the future of global finance.

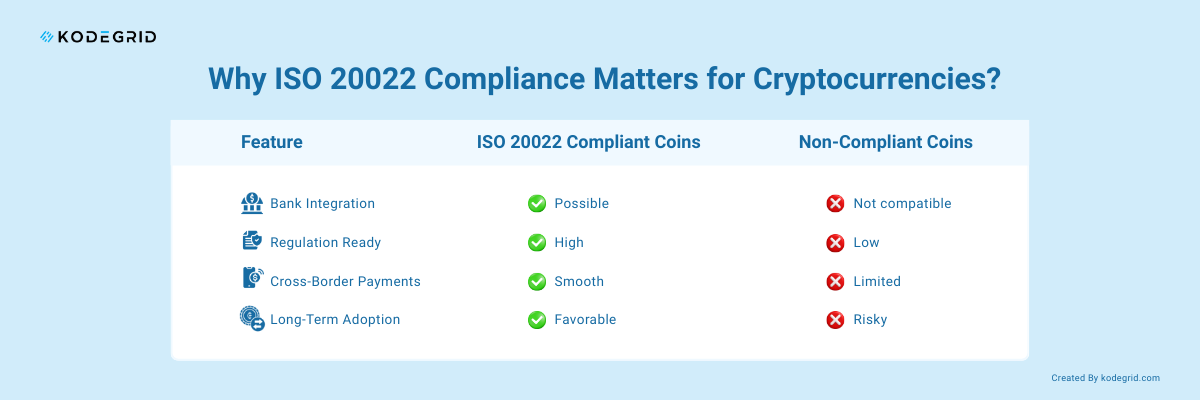

Most crypto projects talk about utility, but very few can connect with the real financial system. ISO 20022 compliance changes that.

The following cryptocurrency projects have adopted ISO 20022, positioning themselves as integral players in mainstream finance. Here’s the iso 20022 crypto coins list—complete with their compliance benefits and future outlook.

As one of the top cryptocurrencies by market cap, XRP has become synonymous with cross-border payments. Ripple, the company behind it, created RippleNet, an enterprise blockchain solution that allows banks, payment providers, and remittance services to settle transactions faster and cheaper than traditional methods.

Unlike the current SWIFT system that may take days, XRP transactions settle in 3–5 seconds, processing up to 1,500 transactions per second (TPS) with negligible fees.

XRP serves as a bridge currency, providing liquidity between fiat pairs and eliminating the need for pre-funded nostro/vostro accounts. By adopting ISO 20022 standards, Ripple ensures iso 20022 XRP is future-proof for seamless integration with legacy financial systems and even upcoming CBDCs (Central Bank Digital Currencies).

Key Benefits of XRP:

Cardano (ADA) is often described as the “academic blockchain” because of its peer-reviewed, research-driven development. It has grown to be one of the top proof-of-stake (PoS) networks, with a market cap of $14B+ in 2024.

Its modular architecture allows developers to build scalable and secure DeFi solutions, making it a good candidate for ISO 20022 compliance. Cardano has already made strides in Africa, partnering with governments and NGOs to issue digital IDs, blockchain-based education records, and financial infrastructure.

Compliance Benefit: Cardano’s structured governance and modular development make aligning with ISO 20022 more feasible than many other layer-1 blockchains.

Key Benefits of ADA:

Stellar (XLM) was built with one mission: to enable low-cost, cross-border payments. The Stellar Development Foundation, co-founded by Jed McCaleb (ex-Ripple), focuses on remittances and micropayments.

In 2024, Stellar processed 11+ million daily transactions, with fees often costing fractions of a cent. It’s particularly popular in regions with limited banking access, making it highly relevant in the $860B+ global remittance industry (World Bank, 2023).

Compliance Benefit: Stellar was designed to integrate with financial institutions, making ISO 20022 alignment natural.

Key Benefits of XLM:

Unlike most blockchains, IOTA doesn’t use traditional blocks or miners. Instead, it runs on a Tangle (DAG – Directed Acyclic Graph) architecture, which allows feeless, instant transactions.

IOTA’s niche is the Internet of Things (IoT) economy, where billions of devices—from cars to smart meters—can transact tiny amounts of value in real-time. This makes IOTA a strong contender for ISO 20022 adoption, as it naturally fits machine-to-machine financial messaging.

Compliance Benefit: IOTA’s focus on interoperability and automation aligns with ISO 20022’s structured data exchange.

Key Benefits of IOTA:

Algorand is a high-performance blockchain founded by MIT cryptographer Silvio Micali. It can process over 1,000 TPS with near-instant finality and extremely low costs.

Algorand is known for being environmentally sustainable (carbon-negative blockchain) and for attracting governments and enterprises. For instance, it was chosen to power the Marshall Islands’ CBDC project.

Compliance Benefit: Algorand’s scalability and institutional partnerships make it naturally suited for ISO 20022 compatibility.

Key Benefits of ALGO:

Hedera Hashgraph is not a traditional blockchain—it’s a hashgraph-based distributed ledger known for speed, fairness, and efficiency. In 2024, Hedera hit 33M+ daily transactions, making it one of the most used enterprise DLTs.

Governed by a council of Fortune 500 giants like Google, IBM, Boeing, and LG, Hedera has positioned itself as the enterprise blockchain for real-world applications.

Compliance Benefit: Hedera’s enterprise-grade governance and scalability align well with ISO 20022’s data-heavy requirements.

Key Benefits of HBAR:

Global finance is moving fast—over 70% of cross-border payment systems are expected to adopt ISO 20022 by 2025. For crypto, this isn’t just a technical upgrade—it’s a regulatory turning point. With governments tightening AML (Anti-Money Laundering) and KYC (Know Your Customer) frameworks, ISO 20022 provides the structured, transparent messaging needed to align digital assets with traditional finance rules.

Why it matters for crypto:

👉 ISO 20022 could be the bridge that connects crypto with traditional finance, accelerating mainstream adoption while shaping the next wave of regulation.

ISO 20022 coins are not just “another crypto narrative” — they’re designed for regulatory alignment and institutional adoption. With over 11,000+ financial institutions across 200+ countries transitioning to ISO 20022 by 2030, the coins built on this standard could become the backbone of regulated digital finance.

Yes, regulations may shift timelines, but the trend is irreversible. Unlike hype-driven tokens, ISO 20022 cryptos function as infrastructure coins, enabling smooth cross-border payments, compliance-ready messaging, and interoperability with global banking systems.

As the financial industry shifts to the ISO 20022 standard, cryptocurrencies designed to comply with it are stepping into the spotlight. These coins promise smoother interoperability, faster and cheaper cross-border transactions, and a stronger connection between banks, payment providers, and blockchain networks.

For developers, building an ISO 20022 coin in 2025 is more than just a technical challenge—it’s an opportunity to create projects that can plug directly into the global financial system. For investors and institutions, tracking the rise of these ISO-compliant coins isn’t just about trendspotting, it’s about positioning for the future of money.

The outlook is clear: as adoption of ISO 20022 accelerates, compliant cryptocurrencies could become the backbone of financial innovation—bridging traditional finance and decentralized ecosystems in ways we’ve only started to imagine.