ERC-20 vs BEP-20: Which Token Standard Is Best in 2025?

Blockchain

August 6, 2025

Copy link

Dimpal Kumar

Co-Founder

Table of contents

Table of contents

Thinking of launching your own crypto token?

You’ve probably heard terms like ERC-20 and BEP-20 thrown around like confetti at a Web3 party. But what do they really mean — and more importantly, which one should you choose for your project?

If you’re a business owner exploring token development, this isn’t just geek-speak. Picking the right token standard can make or break your launch. Gas fees, compatibility, investor trust, and long-term scalability — they all hinge on this one early decision.

In this guide, we’ll break down ERC-20 vs BEP-20, explain their core differences, and help you make a smart, future-ready choice. Let’s start with the basics.

Token standards are like rules or blueprints that define how tokens behave on a blockchain. They ensure that tokens can be sent, received, tracked, and integrated with wallets, smart contracts, and decentralized applications (DApps) — all without chaos.

Think of them as the universal language of tokens. Without a standard, every app would need custom code to interact with each token. With standards, everything just… works.

At the smart contract level, token standards:

Without these standards, developers would need to build custom logic for every single token interaction, drastically increasing complexity, risk of bugs, and fragmentation across the ecosystem.

There are several token standards across different blockchains. Some of the most commonly used are:

But when it comes to building a fungible crypto token that’s fast, scalable, and recognized across ecosystems, ERC-20 and BEP-20 are the heavyweights.

The ERC-20 token standard is a technical specification used to create fungible tokens on the Ethereum blockchain. Introduced in 2015 by developer Fabian Vogelsteller, it was designed to bring universal consistency to how tokens interact with Ethereum smart contracts, wallets, and decentralized applications.

“ERC” stands for Ethereum Request for Comments, and “20” is simply the proposal number.

So: ERC-20 = Ethereum’s 20th community-defined token protocol.

Before ERC-20, developers were coding their tokens from scratch — leading to incompatibility, fragmentation, and wallet chaos. ERC-20 changed the game by providing a set of standard functions and events every token contract must implement, ensuring seamless interoperability across the Ethereum ecosystem.

Key Features:

BEP-20 is the token standard for the Binance Smart Chain (BSC) — and it’s essentially Binance’s version of Ethereum’s ERC-20 standard. It defines how tokens on BSC should behave, making it possible for them to interact with wallets, DApps, exchanges, and smart contracts in a predictable and secure way.

Created to be EVM-compatible (Ethereum Virtual Machine), BEP-20 is technically modeled after ERC-20 but adds enhancements tailored for the Binance Smart Chain’s architecture, such as lower fees, faster finality, and native compatibility with Binance’s broader ecosystem.

Key Features:

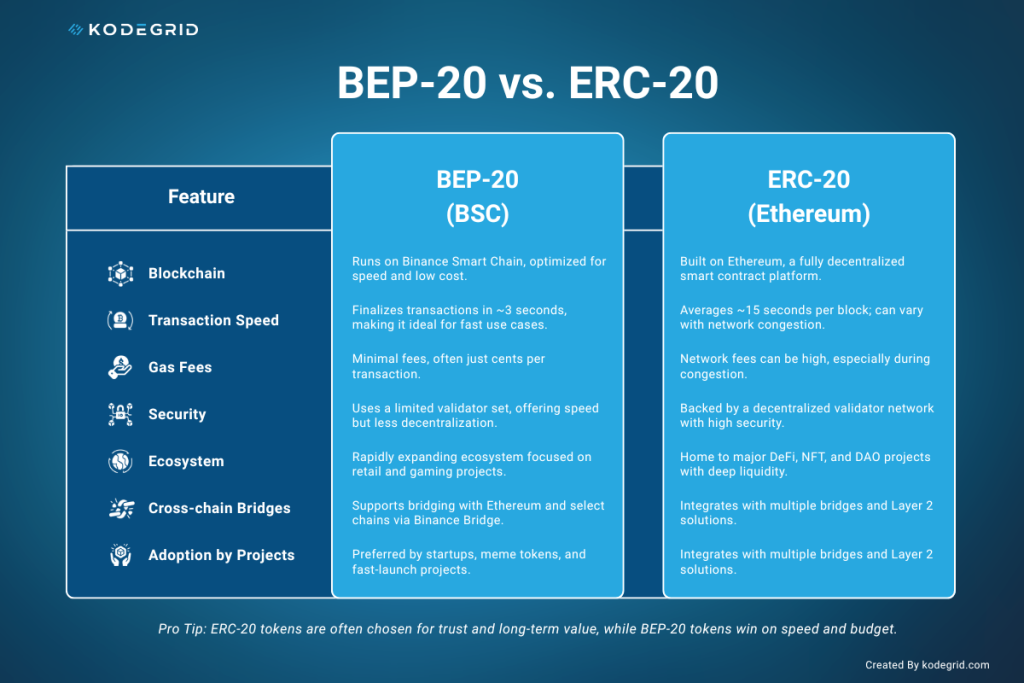

Here’s where it gets interesting. Let’s break down the core differences between these two token standards:

Ah, the million-dollar question. The answer? It depends on your business goals. Let’s break it down.

If your project is focused on speed, affordability, and a quick MVP launch, BEP-20 is a solid choice.

If you’re targeting DeFi integrations, institutional investors, or large-scale token economics, go ERC-20.

Ethereum has been battle-tested. Projects launching ERC-20 tokens often enjoy greater trust, especially from seasoned investors.

BEP-20 runs laps around ERC-20 in terms of cost and speed. For budget-conscious startups or high-frequency applications like gaming, it’s a no-brainer.

While BSC is growing, Ethereum’s ecosystem is more mature. If your token needs to interact with multiple DeFi protocols, DAOs, or L2s, go ERC-20.

Ethereum is moving fast with upgrades like ETH 2.0, Layer 2 rollups, and zkEVMs. If you’re building for the long haul, Ethereum gives you future flexibility and deeper community roots.

Ask yourself:

If you’re unsure, consider starting on BEP-20 for early testing, then upgrading or bridging to ERC-20 once you hit scale.

Choosing between ERC-20 and BEP-20 isn’t about one being “better” — it’s about picking what’s best aligned with your business goals.

ERC-20 tokens give you trust, ecosystem depth, and decentralization. BEP-20 tokens give you speed, affordability, and quicker time to market.

So don’t just follow the trend. Choose the standard that empowers your project — technically, financially, and strategically.